virginia estimated tax payments due dates 2021

Returns are due the 15th day of the 4th month after the close of your fiscal. Virginia estimated tax payments due dates 2021.

Where S My Refund West Virginia H R Block

Due dates for 2019 Virginia Estimated Tax are.

. Estimated income tax payments must be made in full on or before May 1 2022 or in. October 27 2020 October 27 2020 Leave a Comment. Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2022.

Set up or log in securely at. If the ending month for the taxable year of the corporation is March 2021. Please enter your payment details below.

If you file your 2021 income tax return and pay the balance of tax due in full by March 1 2022 you are not required to make the estimated tax payment that would normally be due on January 15. 11 2021 and up to june 15 2021 can now be paid on or before june 15 2021. Individual Income Tax Filing Due Dates.

The District of Columbia has not. 31 2021 can be e. West Virginia Code 16A-9-1d Sales and Use Tax.

VIRGINIA ESTIMATED INCOME TAX PAYMENT VOUCHERS 2022 FOR INDIVIDUALS FORM 760ES Form 760ES Vouchers and Instructions wwwtaxvirginiagov Effective for payments made on. If you file Federal estimated payments April 15 is still your due date for the first quarter 2021 estimated tax payment. Virginia estimated tax payments due dates 2021.

First quarter 2021 estimated tax payments are still due may 1. Virginia estimated tax due dates 2021. Please enter your payment details below.

Individual Estimated Tax Payments - Virginia. Due dates for 2021 estimated tax payments. Estimated income tax payments must be made in full on or before May 1 2021 or in equal installments on or before May 1 2021 June 15.

Make final estimated tax payments for 2021 by Tuesday January 18 2022 to help avoid a possible assessment for taxes owed and penalties. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this. Virginia estimated tax payments due dates 2021.

The blue house petition. If you file your return after March 1 without making the January payment or if you have not paid the proper amount of estimated tax on any earlier due date you may be liable for an additional charge for. Is still due April 15.

Savings. Which the estimated payment is made not the ending date for the quarter the estimated payment is made. Any installment payment of estimated tax exceeds 2500 or Any payment made for an extension of time to file exceeds.

The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter. The 2021 Virginia State Income Tax Return for Tax Year 2021 Jan. An estimated payment worksheet is available through your individual online services account to help you determine your.

Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2021. 15 de dezembro de. Virginia estimated tax payments due dates 2021.

If you file your state income tax return and pay the balance of tax due in full by March 1 you are not required to make the estimated tax payment that would normally be due on Jan. The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter. Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2021.

If you file your 2021 income tax return and pay the. Make a Payment Bills Pay bills or set up a payment plan for all individual and business taxes Individual Taxes Make tax due estimated tax and extension payments. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this.

Daihatsu fourtrak for sale northern ireland Área do Aluno. Typically most people must file their tax return by May 1.

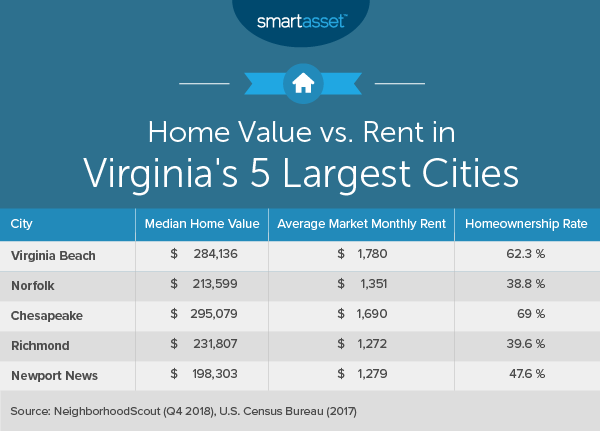

What Is The Cost Of Living In Virginia Smartasset

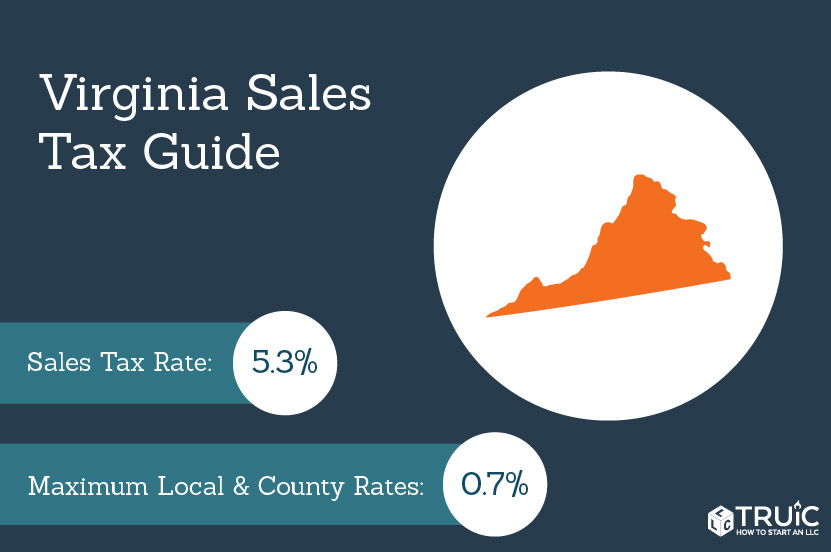

Virginia Sales Tax Small Business Guide Truic

Virginia Dpb Frequently Asked Questions

Virginia Dpb Frequently Asked Questions

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Virginia S Individual Income Tax Filing Extension Deadline For 2020 Taxes Is Nov 17 2021 Virginia Tax

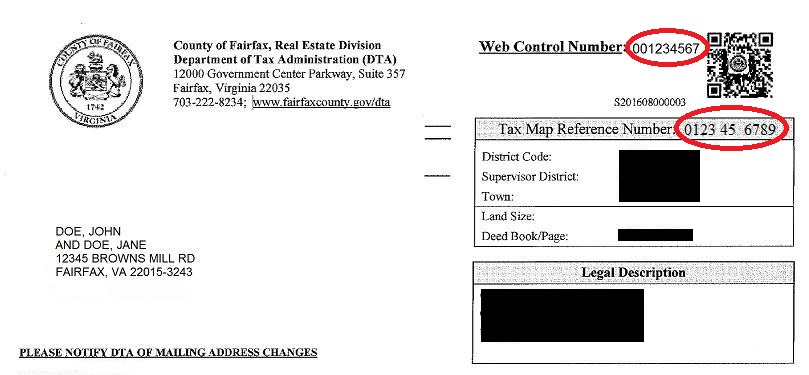

Real Estate Tax Frequently Asked Questions Tax Administration

Cemeteries In Charlotte County Virginia Find A Grave County Instagram Tutorial Virginia

Virginia State Taxes 2022 Tax Season Forbes Advisor

Virginia Dpb Frequently Asked Questions

Prepare And Efile Your 2021 2022 Virginia Income Tax Return

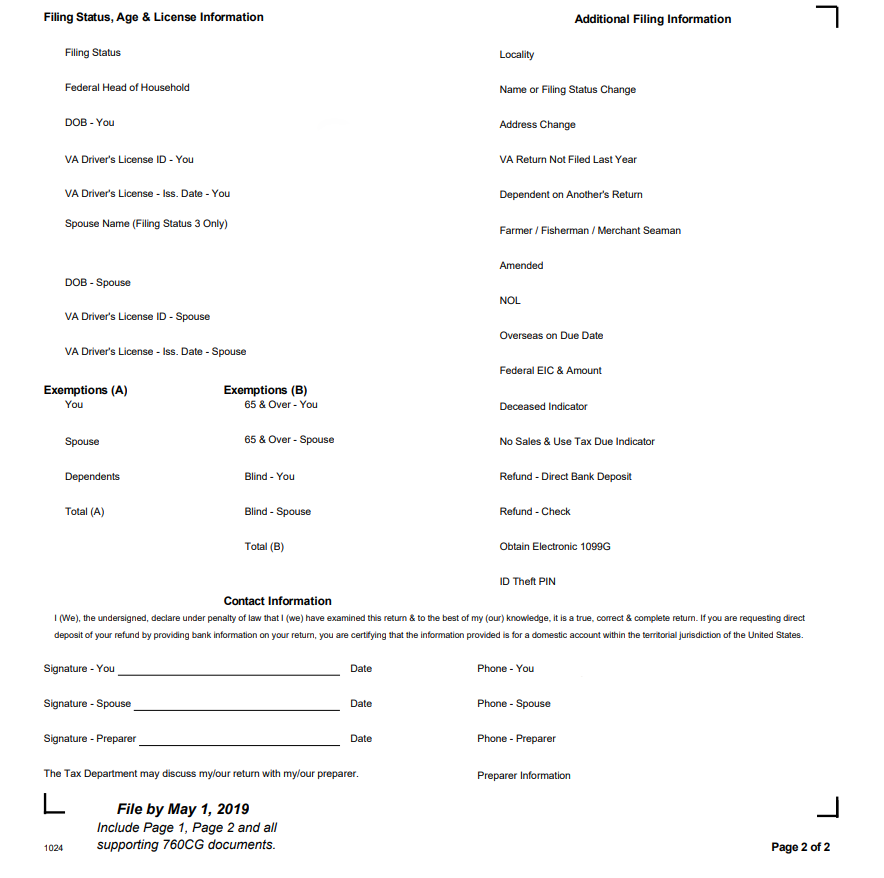

Virginia Tax Forms 2021 Printable State Va 760 Form And Va 760 Instructions

Pay Online Chesterfield County Va

Instructions On How To Prepare Your Virginia Tax Return Amendment

Virginia Sales Tax Guide And Calculator 2022 Taxjar

Va Disability Pay Schedule 2022 Update Hill Ponton P A

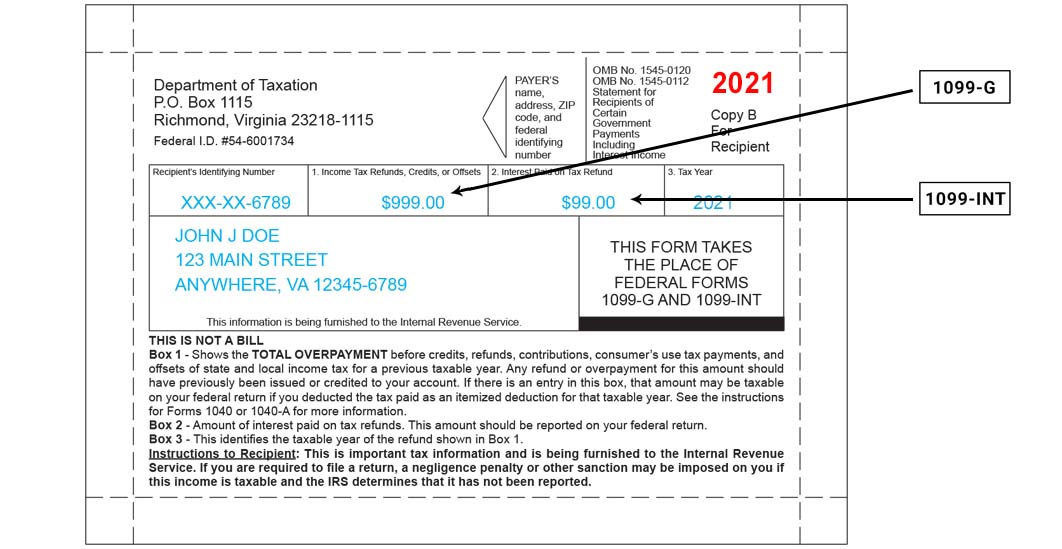

1099 G 1099 Ints Now Available Virginia Tax

Pay Online Chesterfield County Va

2022 Va Disability Pay Rates Veterans Guardian Va Claim Consulting