property tax rates philadelphia suburbs

Philadelphia County collects relatively high property taxes and is ranked in the top half of all counties in the United States by. This data is based on a 5-year study of median property tax rates on owner-occupied homes in.

Nj Or Pa Philadelphia Suburbs The First Time Homeowners Dilemma

The median property tax also known as real estate tax in Philadelphia County is 123600 per year based on a median home value of 13520000 and a median effective property tax rate of 091 of property value.

/cloudfront-us-east-1.images.arcpublishing.com/pmn/LBIKUQ4RP5E7FGH3E5BC72EPUU.jpg)

. For the home in Fairmount listed above with a market value of 528500 the. On top of that tax rate Philadelphia also charges a municipal income tax known as a local earned income tax which is 3891. Rating 391 out of 5.

The median property tax also known as real estate tax in Philadelphia County is 123600 per year based on a median home value of 13520000 and a median effective property tax rate of 091 of property value. The city boosted its sales. Explore the best suburbs to buy a house based on home values property taxes home ownership rates housing costs and real estate trends.

Property tax in Philadelphia County is calculated by multiplying the taxable value with the corresponding tax rates and is an estimate of what an owner not benefiting from tax exemptions would pay. 3 Suburbs with the Lowest Cost of Living in Philadelphia Area. To find detailed property tax statistics for any county in Pennsylvania click the countys name in the data table above.

Bucks and Montgomery Counties kept their rates the same but at least 28 municipalities raised real estate levies. There is a general property tax rate of 13998 for the whole county comprised of 06317 allocated to the city and 07681 allocated to schools. Property tax bill assigned market value x 013998.

The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200. Driving the change was the gradual decline in the citys wage tax rates and a decrease in effective property taxes. Tax bills in the suburbs falling income tax rates in Philadelphia and lower property assessments relative to home values in Philadelphia during the period.

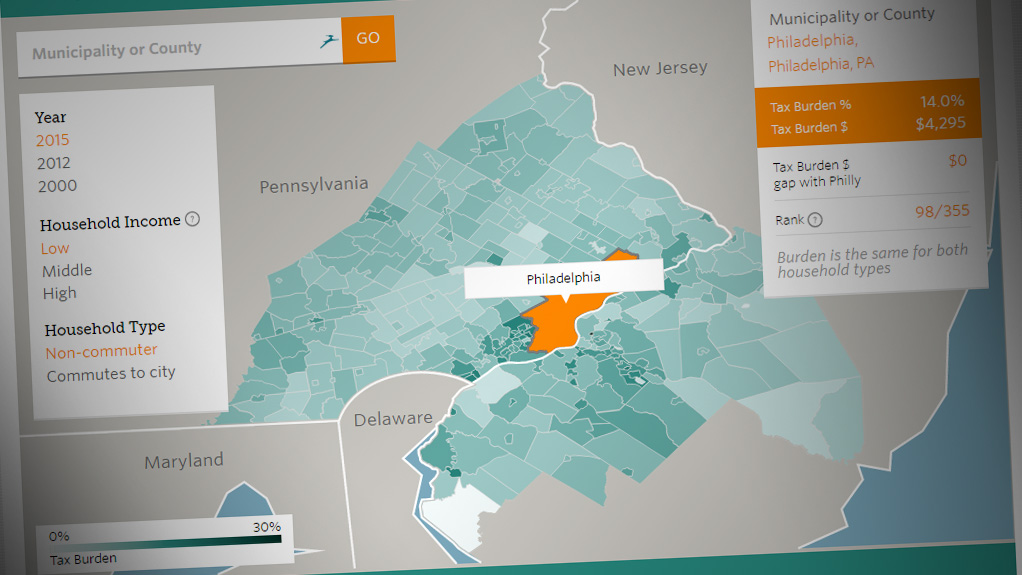

Tax amount varies by county. Tax rates differ depending on which specific town or county youre a part of so its difficult to do a side-by-side comparison of all Philadelphia PA suburbs and all New Jersey suburbs. Current taxes in Philadelphia compared to some local suburbs and how that could change with the Actual Value Initiative.

The gap between the average. Kaitlyn Foti Patch Staff. I have lived here my whole life and the schools are fairly good as far as I saw and experienced.

The Swedesboro-Logan township area is a great place to live. Report a change to lot lines for your property taxes. The new system which is.

Enroll in the Real Estate Tax deferral program. Philadelphias property tax system will change in 2013 if City Council and the mayor follow through with proposed reforms. Some key metrics for each.

Philadelphia County collects on average 091 of a propertys assessed fair market value as property tax. The atmosphere is great not a whole lot of crime. Philadelphia has an added 2 sales tax for a total of 8.

Among the 100 poorest communities in the area Philadelphias tax burden declined from third-heaviest in 2000 to 59th-heaviest in 2015. Play around with making a report of your own but note. The fiscal year 2020 budget does not contain any changes to the tax rate so the same tax rate as 2019 will be used to calculate next years tax bills.

Counties in Pennsylvania collect an average of 135 of a propertys assesed fair market value as property tax per year. Countywide increases approved in December affect the owners of all 382304 real estate parcels in Chester and Delaware Counties. Overall the average property-owning income-earning resident is likely to pay higher taxes in New Jersey than in Pennsylvania.

It also boasts the third-lowest average property tax rates in the state according to the Tax Foundation. Thats about on par with New. Get the Homestead Exemption.

For example if your property is assessed at a 250000 value your annual property tax will be about 3497. At this value paying before the last day in February. If you live in a Main Line suburb South Jersey or Bucks County and your employer is in Philadelphia you will owe Philadelphia 3465.

135 of home value. Look up your property tax balance. However if you pay before the last day of February you are entitled to a 1 discount.

Below you will find a list of counties ranking the counties 66 out of 67 that get the least value for property taxes to the most based on. Heres a basic formula. So a property with an assessed value of 500000 would owe 796950 in property taxes One thing to note is that while Philadephias property tax is 8264 mills the assessed values of most properties is much lower than the actual market value so property tax amounts are generally lower.

The median property tax in Pennsylvania is 222300 per year for a home worth the median value of 16470000. The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the City. In relation to the 100 wealthiest towns Philadelphia had.

Ranking based on data from the US. For the 2022 tax year the rates are. Pennsylvania is ranked 1120th of the 3143 counties in the United States in order of the median amount of property taxes collected.

Effective property tax rates on a county basis range from 091 to 246. In fact the state carries a 150 average effective property tax rate in comparison to the 107 national average. Census FBI and other data sources.

Some people are taking a double hit as at least 27 towns in those counties also have increased taxes. Philadelphia County is located in Pennsylvania. Get Real Estate Tax relief.

The citys current property tax rate is 13998 percent. 06317 City 07681 School District 13998 Total. The statewide sales tax in Pennsylvania is 6.

Active Duty Tax Credit. Read more on how this ranking was calculated. The tax bill is issued on the first day of the year and payment is due beforeon March 31.

Overall Pennsylvania has property tax rates that are higher than national averages. Thats the lowest rate of any of the eight states with a flat income tax. Get a property tax abatement.

According to a more exact calculation the countys average effective property tax rate is 099 percent compared to the states average effective property tax rate of 150 percent.

Philadelphia Cost Of Living 2022 Can You Afford Philadelphia Data

/cloudfront-us-east-1.images.arcpublishing.com/pmn/SK6XMAEIOJGBDMV3ZQKBHE64PU.jpg)

Philadelphia Property Assessments For 2023 Tax Year What To Know

Sparing Philadelphia Homeowners From Increasing Property Tax Burdens

Cost Of Living In Philadelphia Pa 2022 Movingwaldo

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Derek Green S Land Value Tax Resolution Philadelphia 3 0

Comparing The Tax Burden In Philadelphia And The Suburbs The Pew Charitable Trusts

2022 Best Philadelphia Area Suburbs To Buy A House Niche

/cloudfront-us-east-1.images.arcpublishing.com/pmn/TRE43SIKIVB5DMPGVY7BZAR3HA.jpg)

Philly Property Assessments Double In Some Neighborhoods For 2023 Tax Year

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

Philadelphia County Pa Property Tax Search And Records Propertyshark

Do Something Today Something To Do Realty Real Estate Brokerage

Wealth Tax Proposed In Philadelphia With Support From Sen Elizabeth Warren Philadelphia Business Journal

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

This Map Makes It Easy To Compare Your Property Tax Change To Your Neighbors On Top Of Philly News

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

/cloudfront-us-east-1.images.arcpublishing.com/pmn/LBIKUQ4RP5E7FGH3E5BC72EPUU.jpg)

Philly Property Assessments Double In Some Neighborhoods For 2023 Tax Year

When Are Non Residents Exempt From Philadelphia S Wage Tax Department Of Revenue City Of Philadelphia